Giving Back to Crawford County Charities

Planning your philanthropic giving takes time and thought. You will want your gifts to reflect your beliefs and values in life. The Community Foundation of Crawford County’s job is to make this decision-making process easy and enjoyable for you—the Donor. We offer many advantages that may help you in your decision making process:

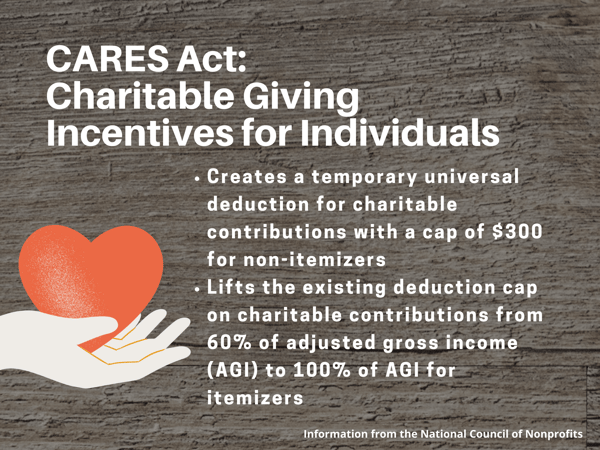

- All gifts to the CF4CC are tax-deductible to the fullest extent allowed by law.

- Donors with Funds at the CF4CC have no additional tax-filing requirements.

- One Designated Fund can provide annual income to a variety of charitable organizations in accordance with your wishes.

- As a local charity, the CF4CC is able to keep administrative costs to a minimum.

We will be happy to spend time with you and explore all the options and possibilities that giving to the CF4CC will afford a donor. The C4CCF staff is willing to work with attorneys, accountants, or other estate planners of your choice to further guarantee your confidence that your gifts will be used to your specifications and achieve their maximum benefit.

Please contact us with questions about how to include the CF4CC in your charitable giving plans. To view our gift acceptance policy, please click here

Tax Free Gift Option for your IRA

Gifts made through the Community Foundation for Crawford County are a safe and convenient way to support your favorite charities through one place. Gifts of any size from your IRA can be directed to any fund at the Foundation, or with a minimum of $5,000 you can establish your own fund designated to support one or more charities in Crawford County.